Albuquerque Rents Increased Again!

Why Owning a Home Can Lock In Your Payment and Build Wealth

The Bottom Line for Albuquerque Residents

Renters face creeping costs with nothing to show for it. Homeowners fix their housing payment, build equity, and benefit from powerful tax advantages that renters never see.

If you’re tired of paying more every year with no return, it’s time to consider ownership. Even if you think you can’t afford it, there are low-down payment programs and local incentives that can make the numbers work.

I’m Waylon Chavez, your Albuquerque real estate advisor at ABQ Premiere Properties.

📞 Call/Text:

505-712-1340

📧 Email:

Waylon@abqpremiereproperties.com

Let’s run a personalized rent vs. buy analysis for you and see how much wealth you could be building instead of giving it away in rent.

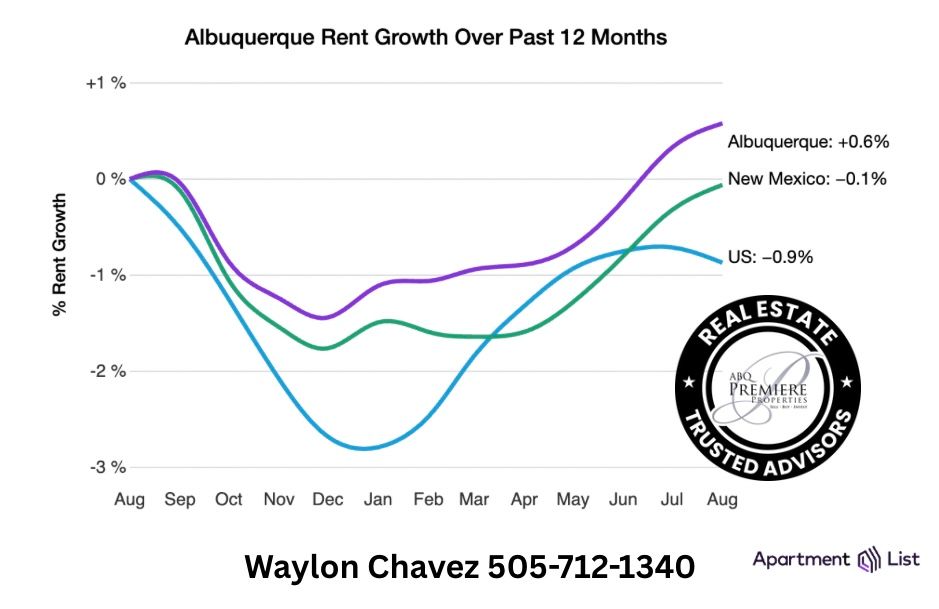

According to the latest Apartment List data, Albuquerque rents increased by 0.2% this past month. That may sound small, but when you add it up over months and years, renters are paying more and more with no stability or long-term benefit.

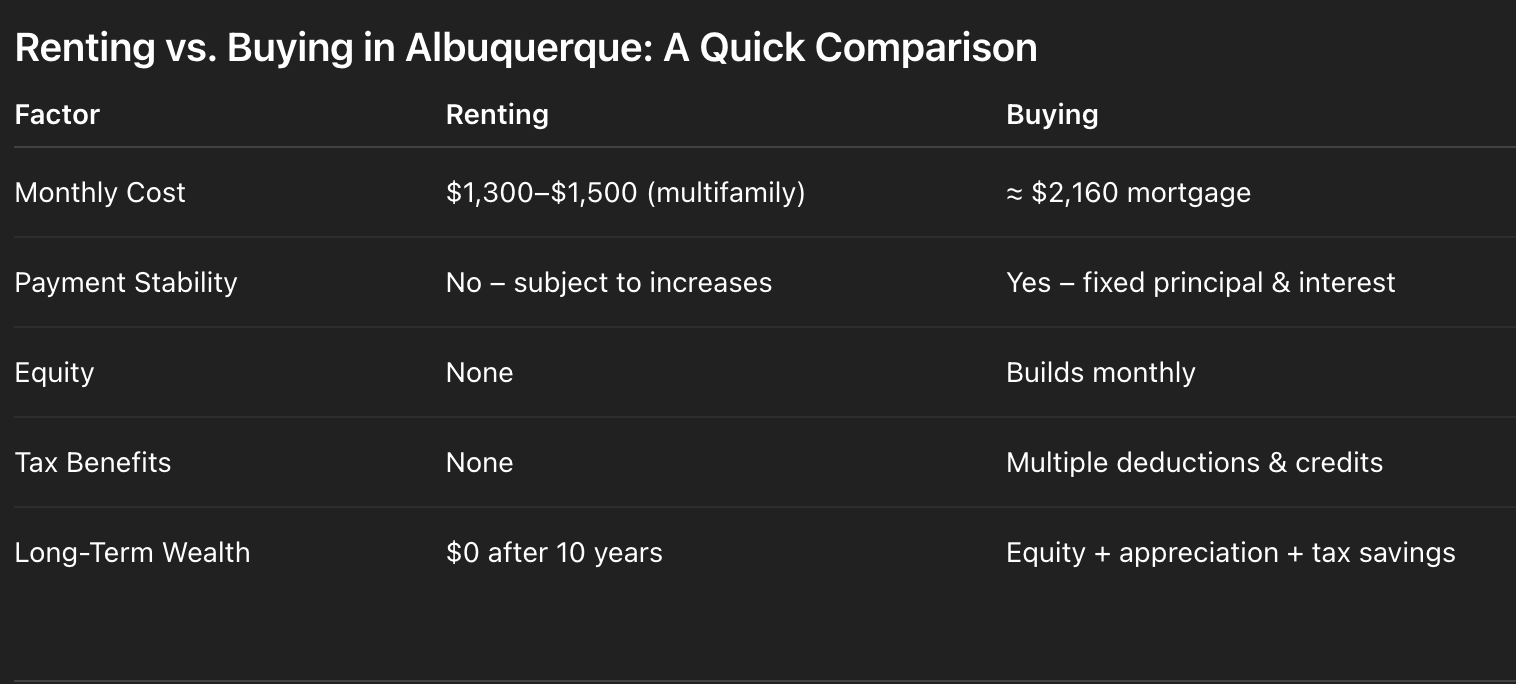

Renting in Albuquerque: What It Really Costs

- Average 2-bedroom rent: $1,300–$1,500/month

- Average multifamily rent: ≈ $1,350/month

- Average single-family rental: ≈ $2,060/month

These numbers move up regularly—your landlord can raise the rent year after year. A “small” 2%–3% increase annually could add hundreds of dollars per month over time, and there’s nothing you can do to control it.

Buying in Albuquerque: Lock In Stability

- Median home price: ≈ $400,000

- Estimated monthly mortgage (30-year fixed at ~7%, 5% down): ≈ $2,050/month (principal & interest). With a fixed-rate mortgage, your principal and interest payment never changes

. While property taxes and insurance may adjust slightly, your largest housing cost stays predictable—no yearly surprises.

Long-Term Wealth Building Through Ownership

When you rent, 100% of your payment goes to the landlord. When you buy, every payment chips away at your loan balance and increases your equity.

- Equity growth: Homeowners steadily build wealth as they pay down the loan.

- Appreciation: Albuquerque homes have been appreciating—median listing prices up 7.2% year over year and median sales up 3.8% year over year.

- Wealth impact: National data shows that for most households, home equity makes up 40–60% of their net worth. That’s why homeowners tend to build wealth, while renters do not.

The Tax Advantages of Owning

Renters have zero tax benefits. Homeowners, on the other hand, can unlock several:

- Mortgage Interest Deduction — Deduct interest paid on mortgage balances (up to $750,000).

- Property Tax Deduction — Deduct state/local property taxes (capped at $10,000).

- Capital Gains Exclusion — Exclude up to $250,000 (single) or $500,000 (married) in profit when you sell your primary home.

- Energy Efficiency Credits — Federal tax credits for upgrades like solar, HVAC, or new windows reduce taxes dollar-for-dollar.

- First-Time Buyer Perks — Up to $10,000 penalty-free IRA withdrawals (or $20,000 if married), plus access to down-payment assistance programs.

- House Hacking Advantage — Rent out part of your property and deduct expenses like mortgage interest, taxes, and maintenance for the rented portion.